An In-depth Analysis of 14 Analyst Recommendations For Floor & Decor Hldgs – Floor & Decor Hldgs (NYSE:FND)

In the last three months, 14 analysts have published ratings on Floor & Decor Hldgs. FNDit offers a range of expectations from bullish to bearish.

Summarizing their latest reviews, the table below shows trends over the past 30 days and compares them to previous months.

| Bullish | It’s almost bullish | Indifference | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Summary of Points | 2 | 4 | 8 | 0 | 0 |

| 30D ago | 0 | 0 | 1 | 0 | 0 |

| 1M ago | 1 | 1 | 2 | 0 | 0 |

| 2M ago | 1 | 3 | 5 | 0 | 0 |

| 3M Previous | 0 | 0 | 0 | 0 | 0 |

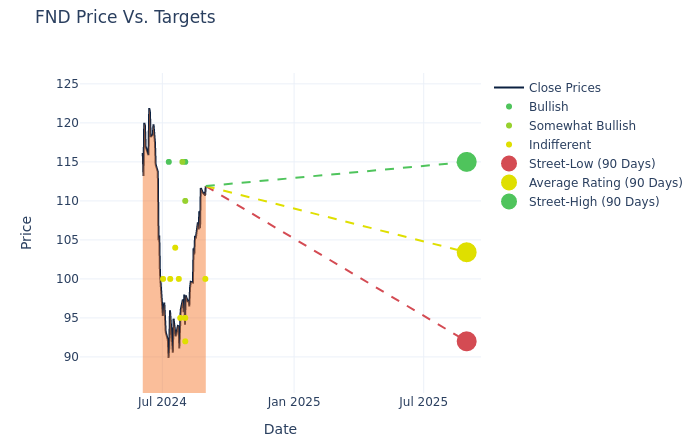

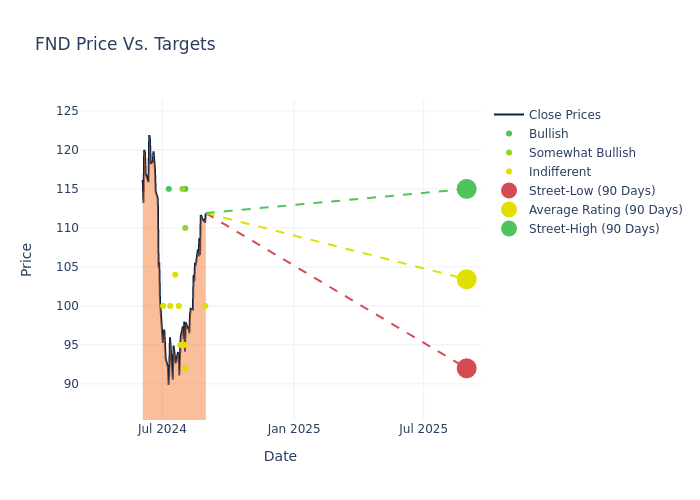

Analysts provide detailed information on their 12-month price estimates, revealing an average target of $105.57, a high estimate of $127.00, and a low estimate of $92.00. This current average is down 9.16% from the previous price target of $116.21.

Disrupting Analyst Ratings: A Comprehensive Review

By examining recent analyst activity, we get an idea of how investors view Floor & Decor Hldgs. The following summary describes key analysts, their latest reviews, and changes in ratings and price targets.

| Inspector | Analysts’ Firm | Action Taken | Details | Current Price Target | Purpose of First Purchase |

|---|---|---|---|---|---|

| W. Andrew Carter | Stifel | It raises | Hold on | $100.00 | $85.00 |

| Christopher Horvers | JP Morgan | Below | Neutral | $92.00 | $99.00 |

| Steven Forbes | Guggenheim | Below | We could | $115.00 | $130.00 |

| Peter Keith | Piper Sandler | Below | Neutral | $95.00 | $115.00 |

| Seth Basham | Wedbush | Save it | More than | $110.00 | $110.00 |

| Justin Kleber | Baird | Below | More than | $115.00 | $127.00 |

| Zachary Fadem | Wells Fargo | Below | Equivalent-Weight | $95.00 | $125.00 |

| Joseph Feldman | Telsey Advisory Group | Below | Make a Market | $100.00 | $110.00 |

| Seth Basham | Wedbush | Below | More than | $110.00 | $125.00 |

| Steven Zaccone | Citigroup | Below | Neutral | $104.00 | $109.00 |

| Max Rahlenko | TD Cowen | Down | Hold on | $100.00 | $115.00 |

| Keith Hughes | Truist Protections | Below | We could | $115.00 | $130.00 |

| Justin Kleber | Baird | Save it | More than | $127.00 | $127.00 |

| Greg Melich | Evercore ISI Group | Below | It’s on the line | $100.00 | $120.00 |

Important information:

- Action Taken: Analysts respond to changes in market conditions and company performance, often revising their recommendations. Whether they ‘Remove’, ‘Raise’ or ‘Lower’ their status, it shows how they react to recent changes related to Floor & Decor Hldgs. These data provide a snapshot of how analysts view the current state of the company.

- Details: When evaluating trends, analysts assign quality ratings, ranging from ‘Outperform’ to ‘Underperform’. This data provides an outlook on the relative performance of Floor & Decor Hldgs compared to the broader market.

- Price Expectations: Upon receiving information, analysts provide estimates of the future value of Floor & Decor Hldgs stock. This comparison reveals trends in analysts’ expectations over time.

Examining these analyst reviews along with key financial indicators can provide a comprehensive overview of the market status of Floor & Decor Hldgs. Stay informed and make informed decisions with the help of our Fact Sheet.

Stay up-to-date with the latest news on Floor & Decor Hldgs.

Discovering Floor & Decor Hldgs: A Closer Look

Floor & Decor Holdings Inc operates as a specialty retailer in the hardwood flooring market. Its stores offer a wide variety of tile, wood, laminate, and natural stone flooring products, as well as decorating and installation supplies at everyday low prices. It attracts a variety of customers including professional installers, commercial businesses, Do-It-Yourself (DIY) customers, and customers purchasing products for professional installation. In terms of location, the group has a presence in the United States and also offers its product through an e-commerce website.

Financial Operations Floor and Decor Hldgs

Market Organization Analysis: Below industry standards, the company’s market capitalization reflects a smaller scale than peers. This may be due to factors such as growth prospects or operational capabilities.

Negative Revenue Trends: Examining Floor & Decor Hldgs financials for 3 months reveals problems. As of June 30, 2024, the company had a decrease of approx. -0.24% in revenue growth, reflecting a decline in top-level earnings. Compared to its industry peers, the company stands out with an above-average growth rate in the Consumer Discretionary sector.

Net Margin: Floor & Decor Hldgs’s margins are impressive, exceeding industry standards. With a network limit of 5.0%, the company shows strong profitability and effective cost control.

Return on Equity (ROE): Floor & Decor Hldgs’ ROE lags behind the industry average, suggesting challenges in maximizing return on capital. With ROE of 2.81%, the company may face obstacles to achieve optimal financial performance.

Return on Assets (ROA): The company’s ROA is below industry standards, indicating potential problems with using assets effectively. By ROA of 1.2%, the company may need to deal with the problems of generating satisfactory returns from its assets.

Credit Management: The company maintains a balanced debt structure with a debt ratio below industry norms, standing at 0.83.

The Importance of Analyst Ratings Explained

Analysts work in banking and financial systems and often specialize in reporting specific stocks or sectors. Analysts may attend company meetings and conferences, research company financial reports, and interview insiders to publish “analyst ratings” for stocks. Analysts typically rate each stock once a quarter.

Analysts can supplement their data with metrics such as growth estimates, earnings and revenue, to give investors a more comprehensive view. However, investors should remember that analysts, like anyone else, may have biases that influence their estimates.

This article was produced by the Benzinga news engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide financial advice. All rights reserved.

#Indepth #Analysis #Analyst #Recommendations #Floor #Decor #Hldgs #Floor #Decor #Hldgs #NYSEFND